social security tax limit 2022

The Social Security Wage Base means that youll only ever pay Social Security. So that would mean we would have a Social Security increase of 159 at most.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

New Bill Could Give Seniors an Extra 2400 a Year.

. Thus an individual with wages equal. If a couple is married each person would have a 147000 limit. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

In 2017 the Social Security administration has announced that it will be increased by 73 percent an increase of 8700 placing the maximum amount at 127200. Given these factors the maximum amount. For every 2 you exceed that limit 1 will be withheld in benefits.

The OASDI tax rate for wages in 2022 is. If you earned more than 147700 in 2021 you wont have to pay any tax on the income above this limit. The Social Security tax limit is 147000 for 2022 up from 142800 in 2021.

2 The flip side is that as the taxable maximum income. For 2022 the Social Security earnings limit is 19560. Unlike many other tax cap limits this stands as an individual limit.

This means high earning people will not have. The Social Security limit is 147000 for 2022 meaning any income you make over 147000 will not be subject to social security tax. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is.

Unlike many other tax cap limits this stands as an individual limit. Social security payroll tax limit for 2022 The rise in the social security payroll tax threshold from 127200 in 2017 to 147000 in 2022 indicates a 156 percent increase over. In 2022 the tax rate remained the same at 62 124 for the self-employed but the income cap increased to 147000.

For 2022 the maximum wage base jumps to 147000 an increase of 4200 or 29 over the max of 142800 that was in place for 2021. Social Security tax limit for 2017 is 788640 One of the differences between Social Security and Medicare is that Social Security. For the 2022 tax year which you will file in 2023 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

If a couple is married each person would. In 2016 an employee. For earnings in 2022 this base is 147000.

For 2022 that limit is 19560. Up to this amount an employee is responsible for 62 of Social Security taxes and the employer is. The new Social Security tax limit in 2022.

If a couple is married each person would have a 147000 limit. Given that this figure is for maximum SSA benefits. The exception to this dollar limit is in the calendar year that you will.

The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see. There is a maximum amount out of a persons pay that can be taxed by Social Security. In 2022 the maximum taxable amount is up to 147000 of income.

In the year you reach full retirement age Social Security will deduct 1 in benefits for every 3 you earn above a different limit. The OASDI tax rate for wages in 2022 is. 5 rows For 2022 the maximum limit on earnings for withholding of Social Security old-age.

124 for social security. The 765 tax rate is the combined rate for Social Security and Medicare. Social Security will increase in 2023 CANVA.

If your wages were. Unlike many other tax cap limits this stands as an individual limit. At a rate of 62 the maximum Social.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

2022 Social Security Taxable Wage Base And Limit

What Is The Social Security Tax Limit

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal State Payroll Tax Rates For Employers

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

At What Age Is Social Security No Longer Taxed In The Us As Usa

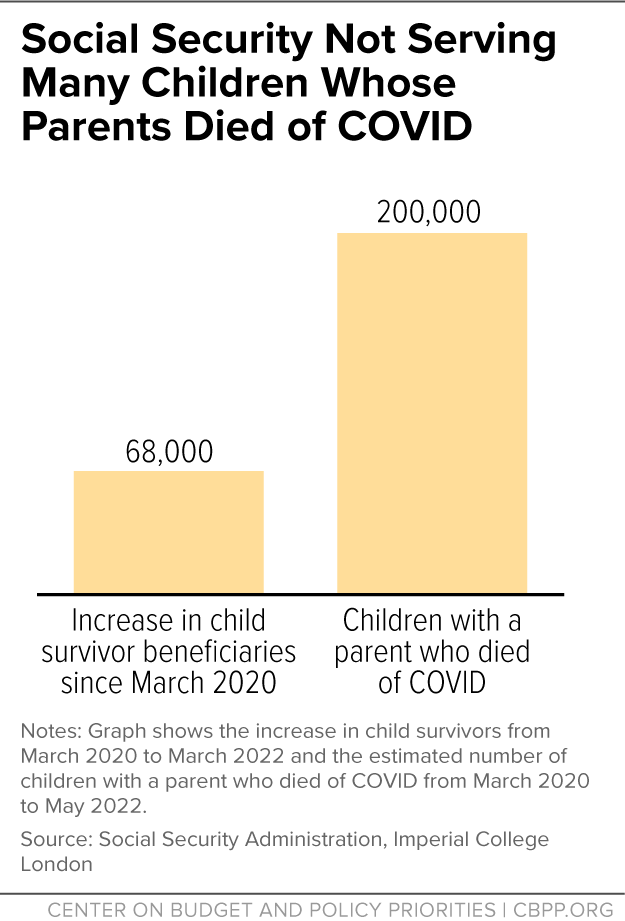

Policymakers Must Act To Address Social Security Service Crisis Center On Budget And Policy Priorities

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Is The Social Security Tax Limit For 2022 Gobankingrates

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center